Our house is more than just four walls, it’s our home. It’s where we lay our heads down at night, where our children feel safe and where we store our valuables. Everything that makes your house a home, you need to do all it takes to protect it.

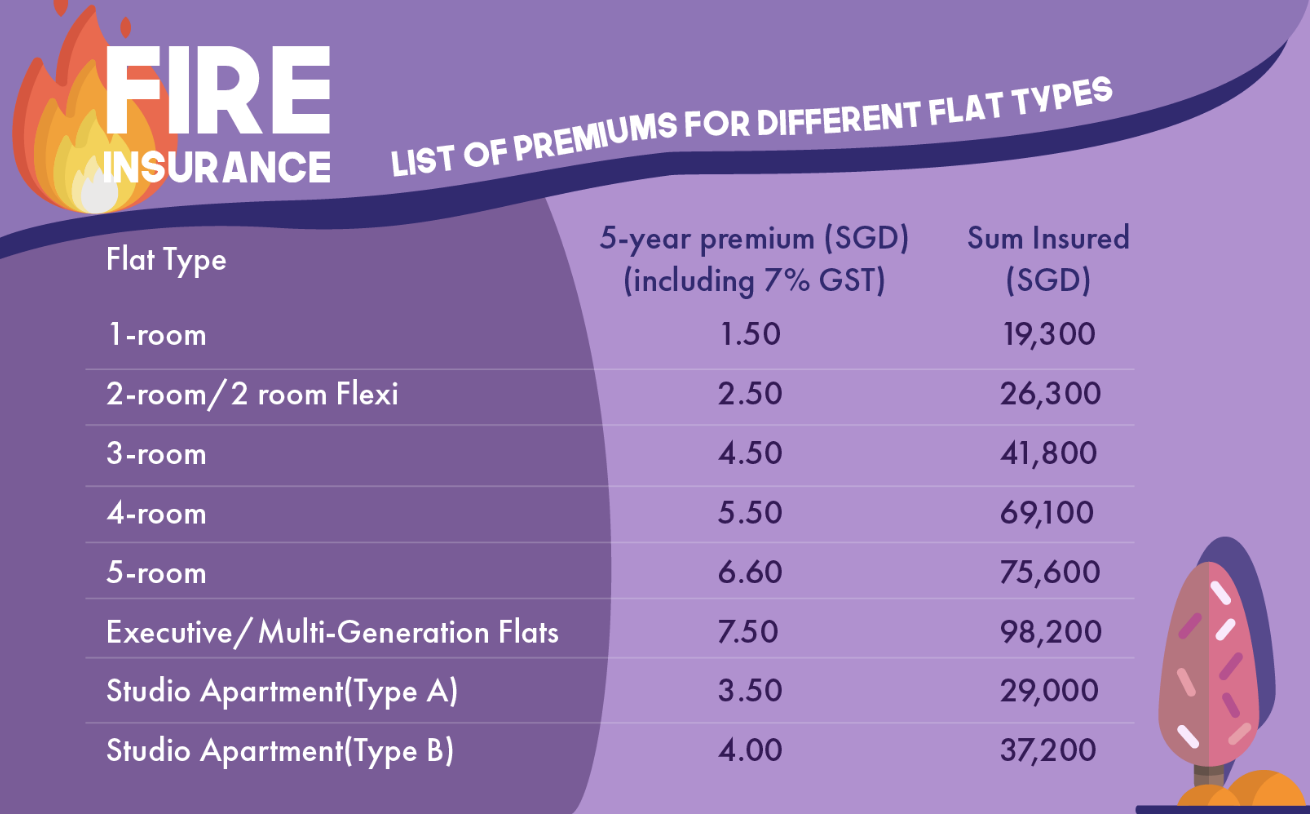

Fire insurance

One of the most important and basic protections a home needs is fire insurance. It is very important to note that fire insurance only offers pay-outs for the cost of damage to your home’s internal building structure, fixtures and fittings provided by HDB and its approved developer.

HDB Fire Insurance is the basic fire insurance cover for your flat. It is mandatory to purchase the HDB Fire Insurance Policy when you take up a HDB loan. Etiqa is the appointed insurer for the HDB Fire Insurance Scheme, which was introduced to help HDB flat owners protect their homes in the event of fire.

Below is the list of premiums for the different flat types:

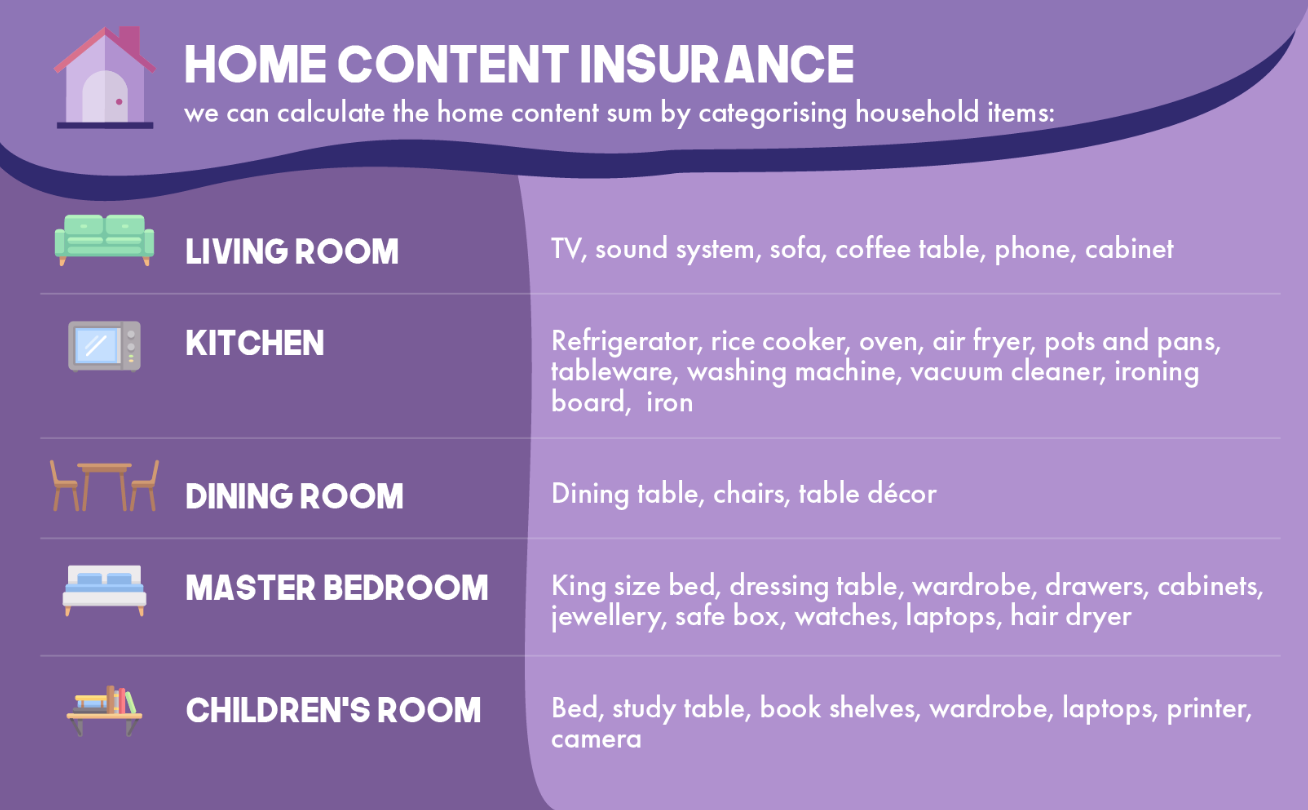

Home Content Insurance

According to research, the average cost of home renovation for a 4-room HDB flat ranges from about $45,000 to about $55,000. However, this excludes furnishing and household appliances. The interior style, whether it is a BTO flat or a resale flat affect the overall cost of renovation. In order to get a better idea on how to determine the Home Content Sum, you will have to consider your renovation works – including any hacking, replacement works etc.

A home content insurance policy complements fire insurance by covering just about everything inside your house – renovations and household items.

Look around your home using the above as a guide and make your own list of items. You should have covered at least 80 to 90% of your household items. Put an estimated value for each item and add them up for the total sum that should be insured to protect your home content.

It is also important to note that there is no standard list of insured risks among the insurers for Home Content Insurance plans. Therefore before committing to an insurer, do ensure that the items insured matches your household items.

Mortgage Insurance

For most Singaporeans, their home mortgage is their single largest liability, and not being able to pay a home loan could have drastic consequences. Legally, your property belongs to whoever is your creditor (mainly, a bank) and your creditor has the right to sell off your property to recover the mortgage you owe them. A mortgage insurance kicks in if something happens that leaves you unable to repay your home loan – it may be due to unemployment or a critical illness.

With mortgage insurance, you get a lump sum payout that enables you to pay for your home loan. HDB owners who use their CPF funds to service their home loan require to be insured under the CPF Home Protection Scheme. Those who are funding their home loans by other means can still choose to be protected by the above-mentioned scheme.