While Singapore may be one of the best places in the world to make money, it’s also one of the best places to spend and save it. When listing places to retire, people tend to include Thailand, the Hamptons or the Costa del Sol. Rarely do they go for Bukit Timah, McRitchie or Changi Village.

As with many things in the world, this may be changing. Singapore’s permissive regulations have meant that the opportunities for building a retirement pot are unique: a stable, growing economy, a strong currency, low taxation and an array of wealth management products form four significant pillars on which to build for a smooth retirement.

Consider also the needs of the empty-nest retiree: healthcare, a luxurious home, high quality of life and access to the finer things in life. The Little Red Dot provides these in an abundance barely matched anywhere in the world. Being perfectly situated at the cross-roads of South East Asia, there will be none of the awful winters that blight the retirees of Europe and America.

A successful professional could do much worse than to commit a significant portion of their later career to getting set up in Singapore, an immensely fertile soil. Insurance-backed savings plans, and widely available world class health insurance would be the two major threads of investment for retirement. These must be carefully tailored to the individual to allow for the expenses of raising a family and a sustainable standard of living during working years while maintaining a balance to ensure successful saving for retirement. The retirement pot must also be carefully and actively managed to ensure continued growth, so that it lasts through to the day when there needs to be some remaining for those left behind – in other words, to leave behind a legacy.

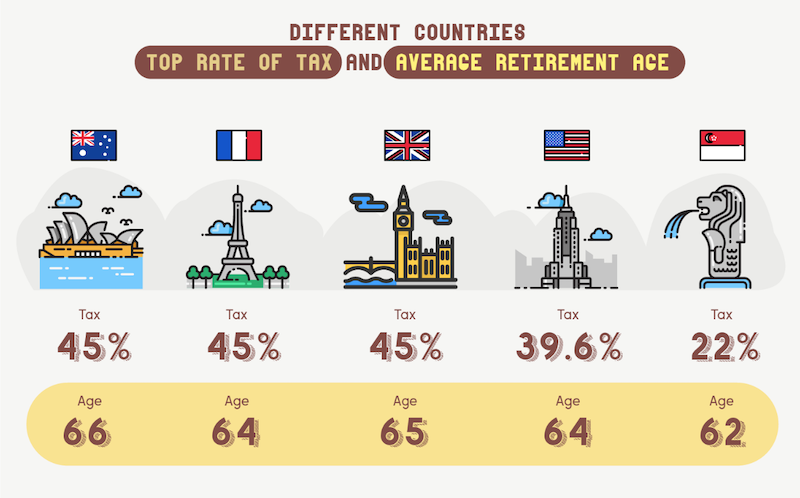

Let’s compare the ability to meet these needs in Singapore to similar economies – the UK, France, Australia, the USA. All have higher taxes, making saving more difficult, and fewer tailored products to choose from; All have significant and growing problems with their healthcare systems; and none of them are in the Tropical region!

So, what do you need to do to start planning to retire in Singapore?

Plan. Find an adviser and have them draw up a plan. Not spreadsheet or pen-and-ink planning but proper, in-depth individual financial modelling, taking every expense into account – from school fees to groceries – and built-in redundancy for the unexpected. A competent, trusted professional will build a series of easy-to-follow projections incorporating you and your family’s likely earnings and expenditures to successfully map out how your life might look, allowing them to suggest the right products and investments to provide that all-important cushion upon which you can rely on to take you through your well-earned retirement.

A well-constructed retirement plan will open Singapore up as the ideal retirement destination, and it will act as the perfect base to build and achieve your retirement dreams. Less money to the tax man, more money in your account for the future you want.