Thinking of buying your own set of wheels? Make sure you’re fully aware of all the costs that come with the ownership of a car. It involves more than finding the best car dealer with the most competitive price or a sustainable monthly payment agreement.

There are many hidden costs that often many new car owners tend to overlook.

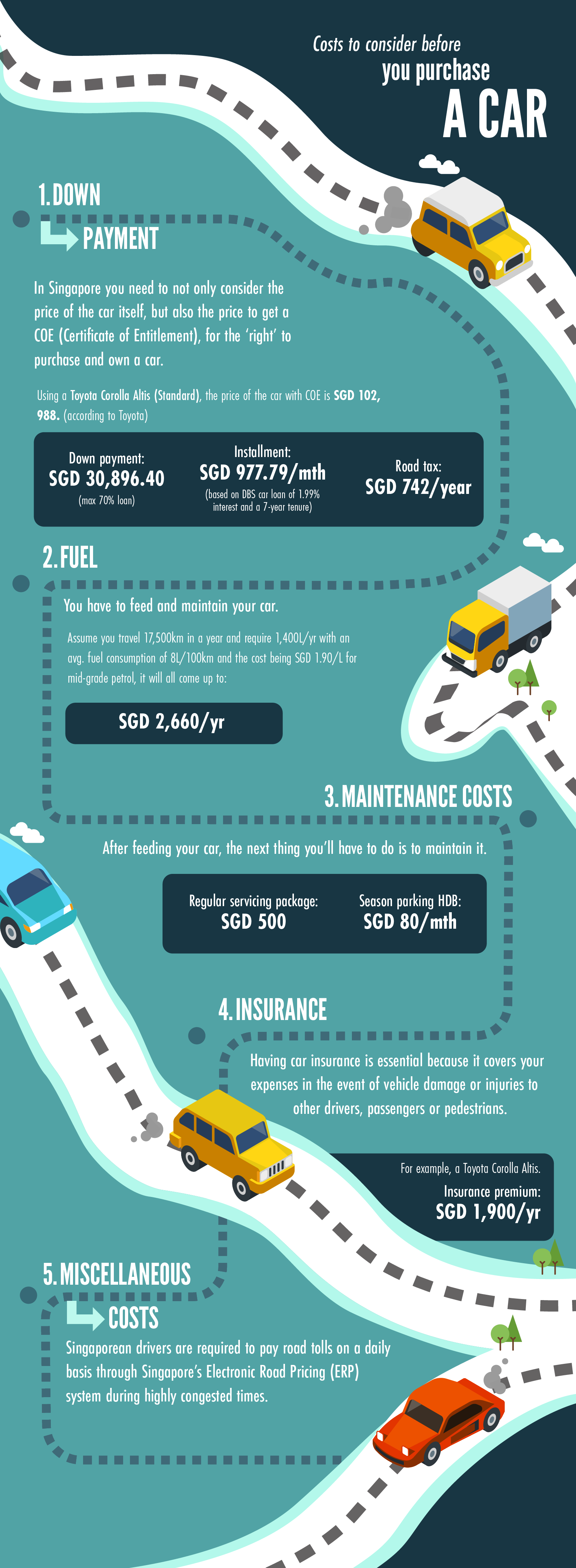

Down payment

The first and most obvious cost you’ll need to consider when you think about purchasing a car is the initial payment – the down payment. Due to the need to regulate the total number of vehicles in Singapore to keep traffic congestion at a manageable level, the purchasing cost includes the price of the car itself as well as the significant amount you’ll have to pay to obtain a Certificate of Entitlement (COE) or the ‘right’ to purchase and own a car. A COE only lets you keep the car for 10 years in Singapore. The figure above is found at the Toyota website.

Fuel

Owning a car comes with a set of responsibilities – you have to feed it and maintain it. According to the Land Transport Authority (LTA), the average car travelled about 17, 500km in a year in 2014 (the most recent year for which this data is available). A car with an average fuel consumption of 8L/100km will require around 1,400L of petrol to cover that distance in a year. Let’s assume that it costs about $1.90/litre for a mid-grade petrol after including discounts etc. It will cost about $2, 660 a year – about $222/month for petrol.

Maintenance costs

After feeding your car, the next thing you’ll have to do is to maintain it. Assuming that there are no major issues with your car, a regular servicing package costs about $500 a year. One other cost that most of us overlook is parking fees. A season parking at HDB will set you back at least $80 a month and if you were to park at CBD areas, the cost will easily be 3 to 4 times that amount.

Insurance

Having car insurance is essential because it covers your expenses in the event of vehicle damage or injuries to other drivers, passengers or pedestrians. Featuring cars like the bestselling Toyota Corolla Altis, the compact sedan class is both popular and relatively affordable in Singapore. You might expect to pay around $1,900 a year on your car insurance premium for a Toyota Corolla Altis. Insurers such as NTUC Income, Aviva and AXA offer relatively lower prices for car insurance within the compact sedan class.

Miscellaneous Costs

Singaporean drivers are required to pay road tolls on a daily basis through Singapore’s Electronic Road Pricing (ERP) system during highly congested times. Singapore controls its traffic congestion in the city through this automated, electronic toll system which charges drivers more during peak hours and in areas that tend to become highly congested.

Owning a car continues to be an aspirational goal for many Singaporeans, though our government urges us to be a car-lite society. Having a car may be convenient and time-saving but it definitely comes with a hefty price to pay. Since buying a car is a huge financial commitment, it requires proper calculation and planning to ensure you can safely afford one.